The VA Guaranteed Home Loan Program has been instrumental in providing home loans for veterans for over seven decades. This program continues to be highly sought after due to the numerous benefits it offers to military veterans and active-duty service members. When applying for a VA home loan, the pre-qualification process plays a crucial role in expediting the loan application process. Pre-qualification allows applicants to assess their eligibility and determine the loan amount they can afford, providing several advantages throughout the homebuying journey.

Understanding Pre-Qualification:

Pre-qualification is a preliminary assessment of an applicant’s loan eligibility and affordability conducted before purchasing a home. While it does not guarantee loan approval, it serves as a valuable indicator that applicants meet initial lender requirements and are highly likely to be approved for a mortgage.

Benefits of Pre-Qualification:

Pre-qualification for a home loan offers prospective buyers several advantages:

1. Determining an affordable price range: By pre-qualifying, buyers can establish the price range of homes they can afford, saving time and effort by focusing their search on suitable properties.

2. Enhanced desirability as a buyer: Sellers often favor buyers who have already been pre-qualified, especially in situations where multiple offers are received. Pre-qualification demonstrates readiness and financial capacity, making buyers more attractive to sellers.

3. Reduced uncertainty: Knowing that you are pre-qualified for a loan alleviates the stress associated with finding and purchasing a home. It provides peace of mind and confidence during the homebuying process.

4. Improved negotiation power: Pre-qualification enables buyers to negotiate better terms and conditions, as they have the assurance of loan approval. This confidence allows for smoother negotiations and potential concessions from sellers.

5. Streamlined closing process: Pre-qualification helps streamline the closing process by minimizing surprises that could cause delays. With pre-qualification, buyers have already met initial requirements, reducing the likelihood of unexpected obstacles arising during the sale’s closing.

How to Get Pre-Qualified for a VA Loan:

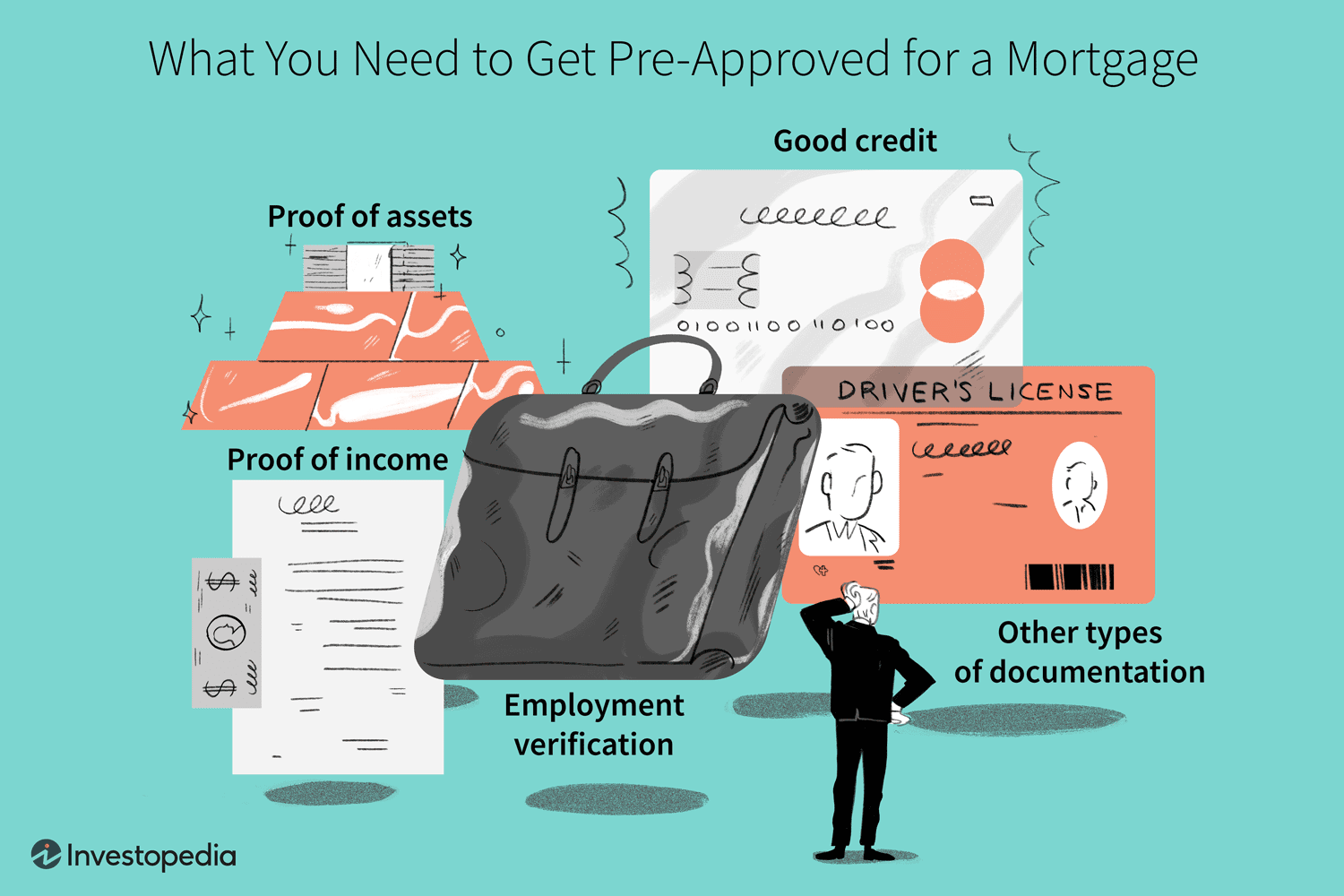

To initiate the pre-qualification process for a VA home loan, applicants must provide certain documents, including:

1. Military service information: A Certificate of Eligibility is necessary to apply for a VA guaranteed home loan. Although the certificate can be obtained by filling out the appropriate form, the pre-qualification process can commence before receiving the certificate. Lenders often assist applicants in filing for the required document.

2. Credit information: Lenders may request permission to review an applicant’s credit score. If any credit issues arise, they may recommend resolving past debts or rectifying incorrect information to improve the chances of pre-approval.

3. Employment details: Proof of current and previous employment is typically required. While lenders prefer to see two years of consistent employment, gaps in employment history do not necessarily disqualify applicants from obtaining a loan.

4. Financial statements: Bank statements, investment statements, and information on real estate ownership are necessary to assess an applicant’s financial health, including savings and investments.

5. Divorce and support documents: Lenders often request divorce decrees and information on spouse/child support payments to evaluate the potential impact on the applicant’s ability to repay the loan.

Conclusion:

Pre-qualification for a VA home loan offers significant advantages to homebuyers, enabling them to find a suitable house within their means. By undergoing the pre-qualification process, buyers can enjoy a competitive edge, negotiate better terms, and streamline the closing process. If you are embarking on your homebuying journey, consider getting pre-qualified for a VA home loan to enhance your chances of securing the ideal home for your needs.

Bali Villas and Luxury Real Estate

Spectacular Villas for Sale in Bali

Discover How to Restore Your Nervous System with Self-Hypnosis

stress management techniques self-empowerment.

Total Drama | The Ultimate Reality Show Adventure

2. Total Drama | A Wild Ride Through the Competition

3. Total Drama | Who Will Survive the Challenges?

4. Total Drama | Drama, Action, and Plenty of Surprises

5. Total Drama | The Juiciest Reality Show on TV

6. Total Drama | Where Drama Reigns Supreme

7. Total Drama | Surviving Against the Odds

8. Total Drama | Can You Handle the Drama?

9. Total Drama | The Ultimate Test of Strength and Skill

10. Total Drama | A Battle of Wits and Endurance

11. Total Drama | Who Will Come Out on Top?

12. Total Drama | The Ultimate Quest for Fame and Fortune

13. Total Drama | Expect the Unexpected

14. Total Drama | The Ultimate Challenge Awaits

15. Total Drama | Will You Be the One to Claim Victory?

16. Total Drama | A Thrilling Adventure You Won’t Want to Miss

17. Total Drama | The Ultimate Reality Show Showdown

18. Total Drama | Surviving the Craziness of Total Drama

19. Total Drama | Ready for a Total Drama Showdown?

20. Total Drama | The Unforgettable Journey to the Top}