In the fast-paced and digital world we live in, managing finances has become more convenient and efficient than ever before, thanks to the rise of financial apps. These apps offer a wide range of tools and features to help individuals and businesses take control of their money, track expenses, and make informed financial decisions. Whether you want to budget, invest, or save for the future, financial apps have you covered. Let’s explore how these apps can revolutionize the way you manage your finances:

1. Personalized Budgeting

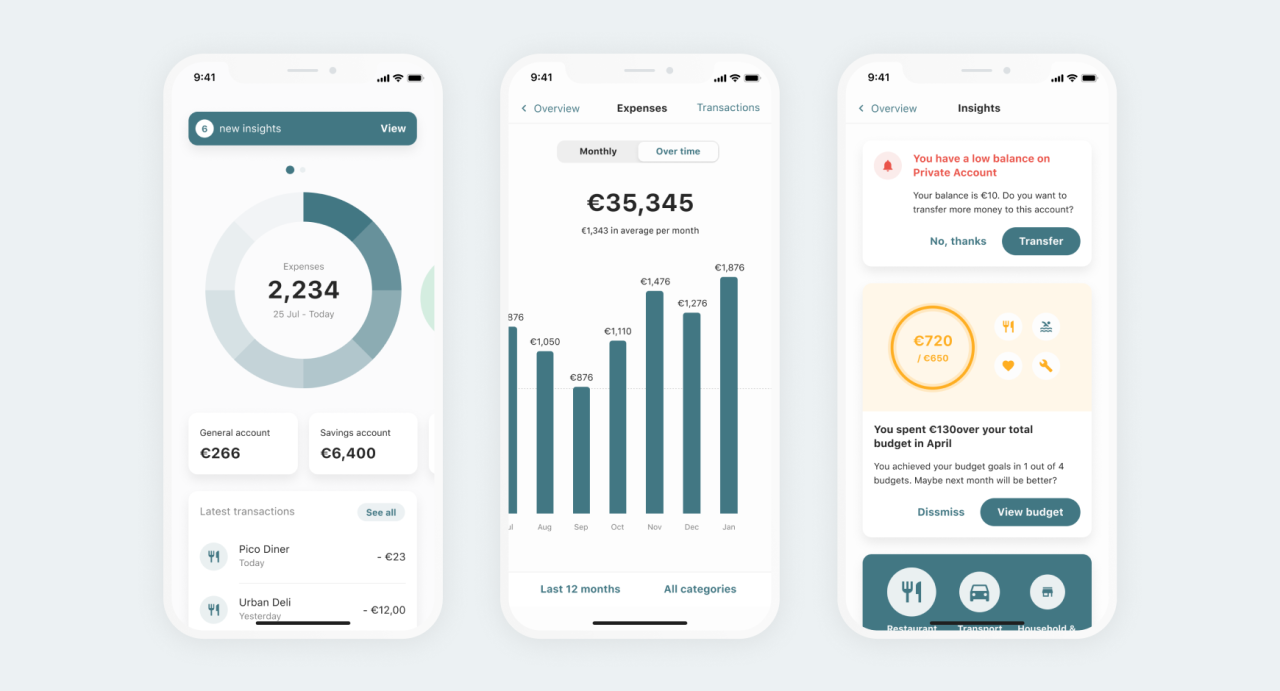

Financial apps allow you to create personalized budgets based on your income, expenses, and financial goals. You can track your spending in real-time and receive alerts when you’re nearing your budget limits.

2. Expense Tracking

Gone are the days of manual expense tracking. Financial apps automatically categorize and record your transactions, providing a clear overview of your spending habits.

3. Investment Management

From stocks and mutual funds to cryptocurrencies, financial apps offer investment management tools that enable you to monitor your portfolio’s performance and make data-driven decisions.

4. Bill Payment Reminders

Never miss a payment deadline again with bill payment reminders. Financial apps notify you of upcoming bills and due dates, helping you avoid late fees and penalties.

5. Financial Goal Setting

Whether you’re saving for a vacation, a new car, or retirement, financial apps help you set and visualize your financial goals. They track your progress and offer guidance on how to achieve them.

6. Credit Score Monitoring

Some financial apps provide credit score monitoring, allowing you to keep an eye on your credit health and take steps to improve it.

7. Tax Planning Assistance

During tax season, financial apps can assist with tax planning, deductions, and filing, simplifying the process and potentially maximizing your tax returns.

8. Secure and Encrypted Transactions

Financial apps prioritize security and use encryption to safeguard your financial data and transactions, providing peace of mind when managing your money digitally.

9. Financial Insights and Trends

Get a comprehensive view of your financial health with insights and trends generated by financial apps. Analyze your spending patterns and identify areas where you can save.

10. Financial Education Resources

Many financial apps offer educational resources and articles to help users improve their financial literacy and make more informed financial decisions.

Conclusion

Financial apps have transformed the way we manage our finances, putting the power of financial management right at our fingertips. With personalized budgeting, expense tracking, investment management, and other valuable features, these apps cater to various financial needs and goals. Whether you’re an individual seeking to stay on top of your personal finances or a business owner looking to optimize financial operations, financial apps offer the tools and insights to make your financial journey smoother and more successful. Embrace the convenience and efficiency of financial apps to take control of your money, build wealth, and achieve your financial aspirations.

https://kamagraes.site/# farmacias online seguras en españa

farmacias online seguras: farmacia online barata y fiable – farmacia online barata

https://kamagraes.site/# farmacia barata